Published: May 9, 2017 1:41 p.m. ET

‘When everyone thinks the world will end, you will be rewarded if it doesn’t’

The investment industry has a little secret and the «Of Dollars and Data» blog just let its readers in on it: «Luck matters a lot more than you think.»

The blogger, who identifies himself only as «Nick,» says he’s not talking about those rare stockpickers with an uncanny knack for the big-profit score. Rather, he’s referring to the variations in asset returns that also impact passive investors.

«Luck is so important that two investors holding the same assets over different time periods can have wildly different investment outcomes,» he wrote. «This implies that even if you followed all of the best investing advice by diversifying, rebalancing, having a high savings rate, etc., you could still end up with a less-than-stellar outcome.»

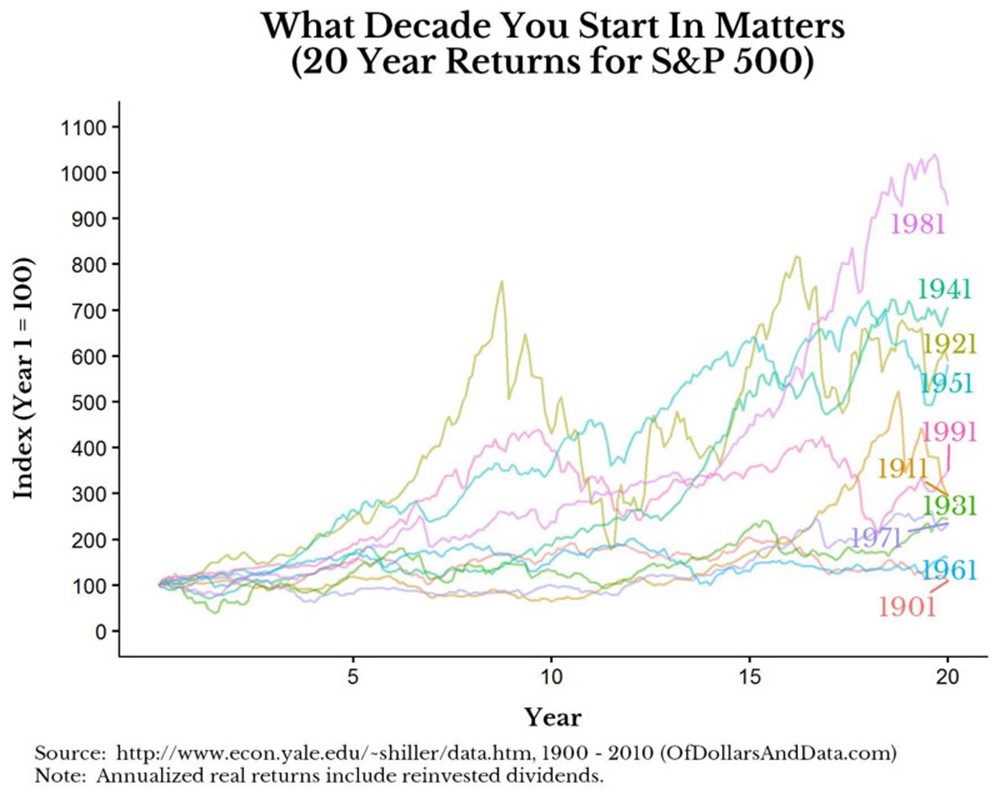

To illustrate his point, Nick took a look at 20-year returns on the S&P 500 SPX, -0.15% starting in each decade from 1901 to 1981 to see how different starting points led to vastly different results. He started each decade at the same point, with an index of 100.

As you can see, the best stretch was from 1981 to 2000. The worst was the beginning of last century. The 1960s starting point wasn’t much better. «The more important point is that there is no general pattern across the decades,» Nick wrote.

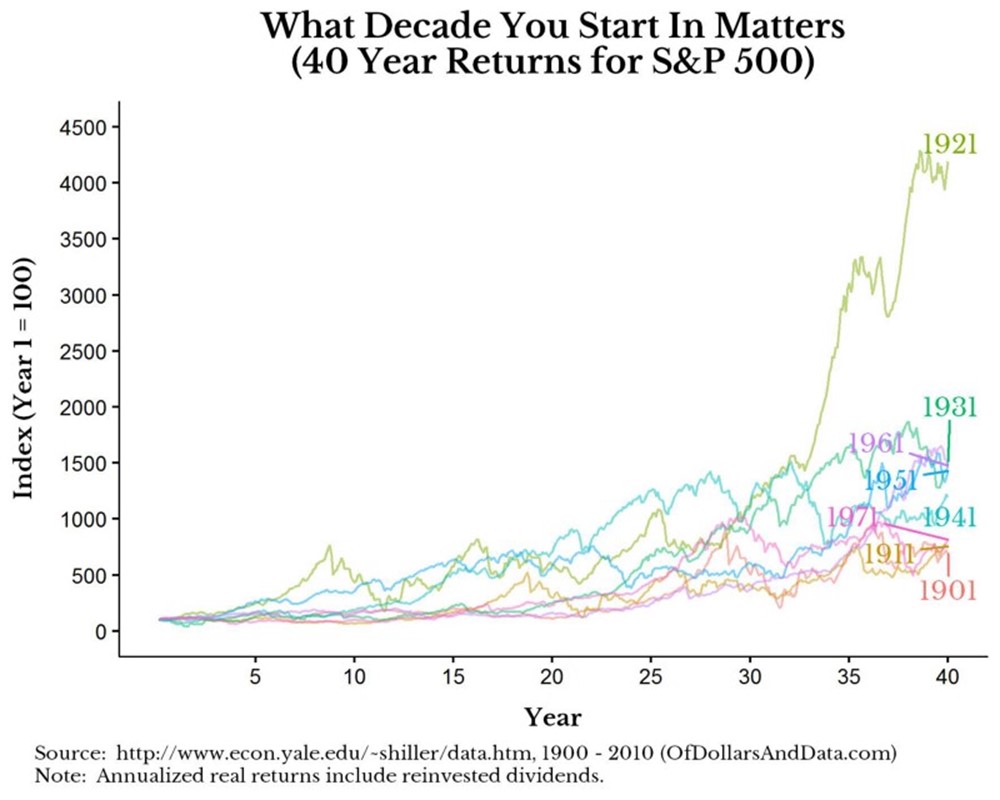

Perhaps the 20-year period feels a bit too random? Sure. So let’s take a look at the same plot but using a 40-year period.

Still, timing is everything.

«This means that someone born in 1880 who started investing at age 21 from 1901–1940 would have done far worse than someone born 20 years later who started investing in 1921–1960,» Nick explained, adding that the period starting in 1921 was a fantastic stretch despite the Great Depression and World War II.

«This illustrates how returns are proportional to the risk borne by investors,» he said. «When everyone thinks the world will end, you will be rewarded if it doesn’t.»

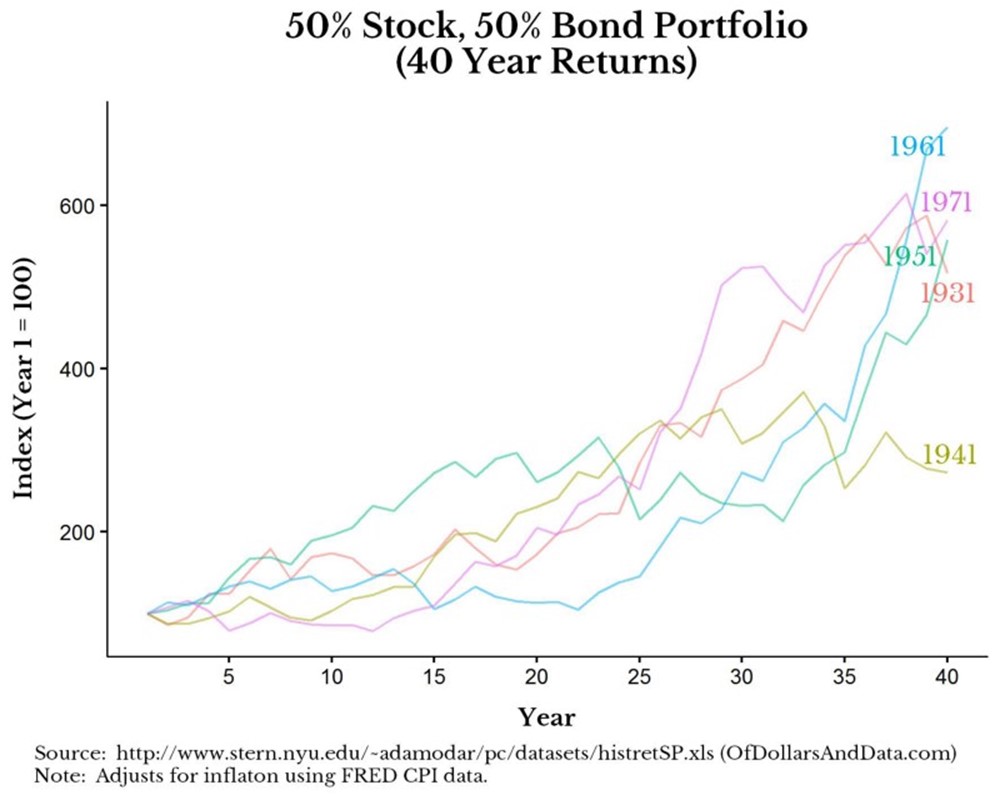

But those are just the numbers that apply to investors fully invested in stocks. Nick added in bonds to show that the divergence in outcomes is still present in a balanced portfolio, though not as drastic.

«This illustrates how superior U.S. stock returns were compared to U.S. bond returns in the 20th Century,» he pointed out. «There is no law stating that this relationship has to hold going forward, but I hope you can see how much random luck (i.e. your birth year) has an impact on your investment outcomes.»