Relative strength is the #1 investment return factor no one wants to talk about. The reasons are not entirely clear to me, but perhaps it is because it is too simple. It does not require a CFA to forecast earnings or to determine an economic moat. It does not require a CPA to attempt to assess valuation. It does not require an MBA to assess strategic business decisions. In short, it does not play to the guild mentality wherein only certain masters of the universe have the elevated intellect, knowledge, and background to invest successfully.

Although relative strength is simple, I am not suggesting that relative strength is easy to implement. Losing weight is simple too: eat less, exercise more. That does not make it easy to do. Relative strength, probably like most successful investment strategies, requires an inordinate amount of discipline—and tolerance of a fair amount of randomness. Like most games that are easy to learn, but difficult to master—chess would be an apt example—proficient use of relative strength also requires deep study and experience.

Yet relative strength has been used successfully by practitioners for many generations. George Chestnutt of the American Investors Fund began using it to run money in the 1930s and said it had been in use by others for at least a generation before that. Relative strength has been shown to work in many asset classes, across many markets for more than 100 years. Since the early 1990s, even academics have gotten in on the act.

And for all that, relative strength remains ignored.

I was reminded of its apparent obscurity again this week when reading an excellent article on indexing by the macrocephalic Rob Arnott. He had a very nice piece in Advisor Perspectives about the virtues of alternative beta indexes.

In recent years, a whole new category of investments—called «alternative betas»—has emerged. Some of these alternative beta strategies, including the Fundamental Index® approach, use various structural schemes to select and/or weight securities in the index. In that sense, they fall between traditional cap-weighted approaches and active management: they pick up broadly diversified market exposure (beta) but seek to produce better results than cap-weighted indexes (what is desired from active managers).

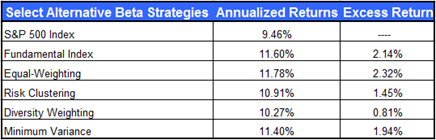

Our CIO, Jason Hsu, and research staff have replicated the basic methodologies of many of these rules-based alternative betas, ranging from a simple equal-weighted approach to the straightforward Fundamental Index strategy to the truly exotic such as risk clustering and diversity weighting.7 The potential rewards are promising. Of the 10 non-cap-weighted U.S. equity strategies studied, all outperformed the passive cap-weighted benchmark. The range of excess returns by alternative beta strategies was between 0.4% and 3.0% per annum—matching a reasonable estimate of the top quartile of active managers—that is, the small cadre of managers who generally are successful at beating the benchmark (see Table 1). The bottom line: investors can obtain top-quartile performance with far less effort than is required to research and monitor traditional active equity managers.

Mr. Arnott has a very good point—and the numbers to prove it. Lots of alternative beta strategies are available that can potentially offer top-quartile performance relative to other active managers and that may also outperform traditional passive cap-weighted benchmarks. He is no doubt proselytizing on behalf of his firm’s Fundamental Index approach to some extent, but I think his underlying thesis is correct. He offers the following table as evidence that alternative beta strategies can outperform, using data from 1964- 2009:

Source: Advisor Perspectives, Research Affiliates (click to enlarge)

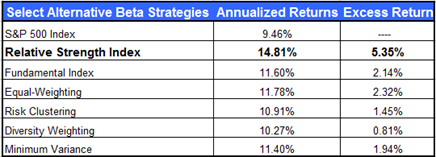

I would like to offer a slight modification of this table, since it is only a listing of «select» alternative beta strategies. Relative strength has been inexplicably excluded. Below, I present the same table of alternative beta strategies now including relative strength, the #1 investment return factor no one wants to talk about. (I have my own theory about why other indexers don’t want to talk about relative strength, but I will let you reach your own conclusions.) The relative strength returns presented in the table are for the exact same time period, 1964 through 2009. They are taken from Professor Ken French’s database and show the results of a simple relative strength selection process when using the top third (as ranked by relative strength) of the large cap universe.

Source: Research Affiliates, Dorsey Wright (click to enlarge)

Are you surprised that relative strength blows away the other alternative beta strategies?

You shouldn’t be. There are plenty of academic and practitioner studies attesting to the power of relative strength. In short, I agree with Mr. Arnott that alternative beta indexes are worth a close look. And I think it would be particularly prudent to consider relative strength weighted indexes.