Tuesday, 10 May 2016 | 12:01 AM ETCNBC.com

You’d think the goal of investing would be to make money. But if you ask clients of financial wealth managers across the globe, «what’s your top goal?,» most of them will say that financial performance is not it.

In fact, only 33 percent rank performance No. 1. The rest of the top picks are either engagement, trust, or some combination of these two or three factors. All these other factors added up to the 67 percent of people who didn’t put financial performance as their most important factor.

The data, brand new in a report from EY’s (formerly Ernst & Young) wealth management practice, suggest that competitor wealth managers don’t actually have to offer the best financial performance in order to steal clients. EY released a report Tuesday based on a global survey of 2,000 wealth management clients and 60 wealth management executives.

It also means current wealth managers could lose their clients even after having good performance.

No real definition of performance

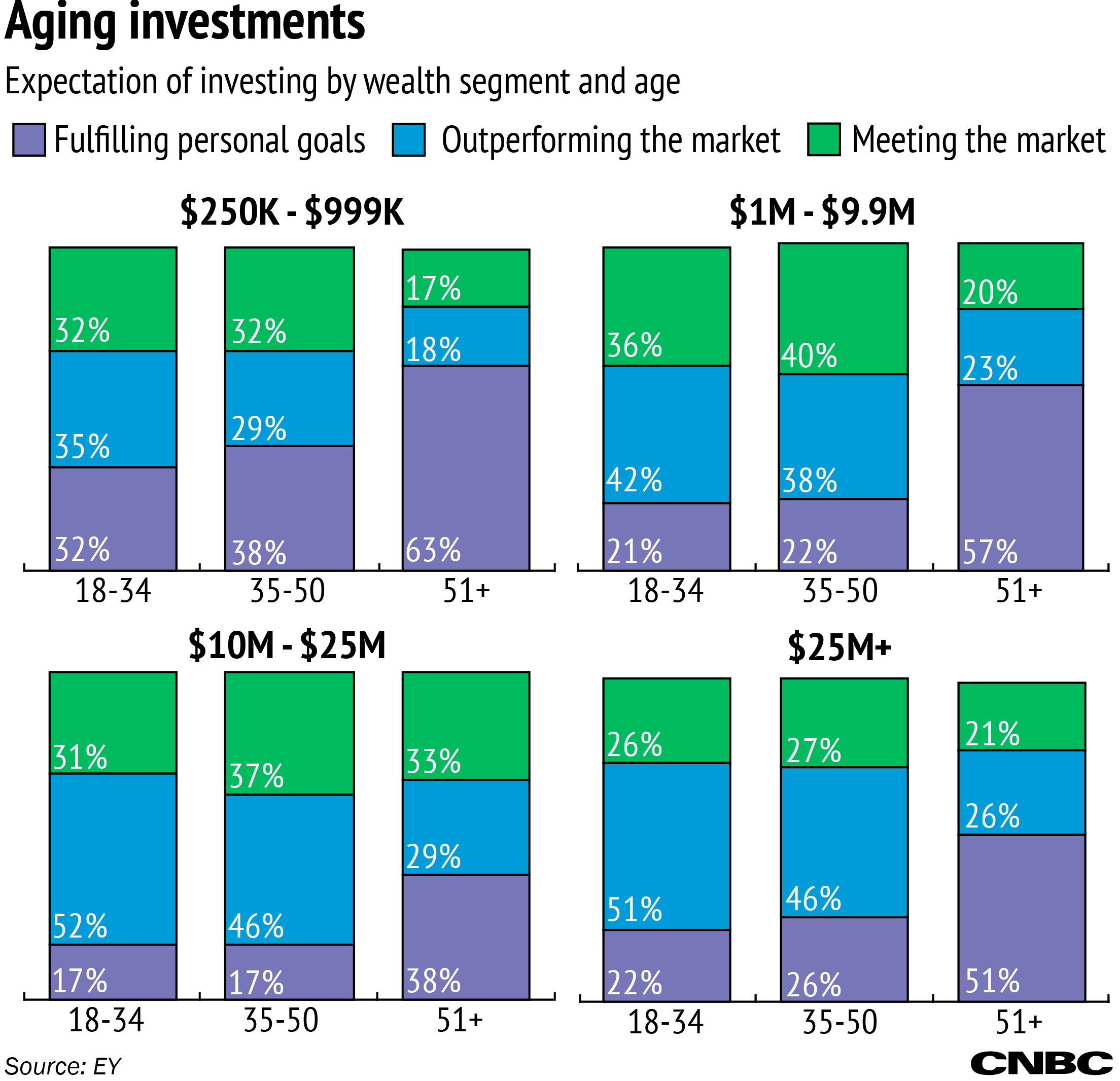

Even more confusing, there is no agreed-upon definition for what performance means. The three top choices, split almost equally into thirds of a pie, were outperforming the market, matching the market or meeting some «client specific financial goals.»

It goes to the point that advisors can do a good job in their own heads of hitting client performance, but clients measure performance against some other benchmark.

Clients don’t know how they should be charged

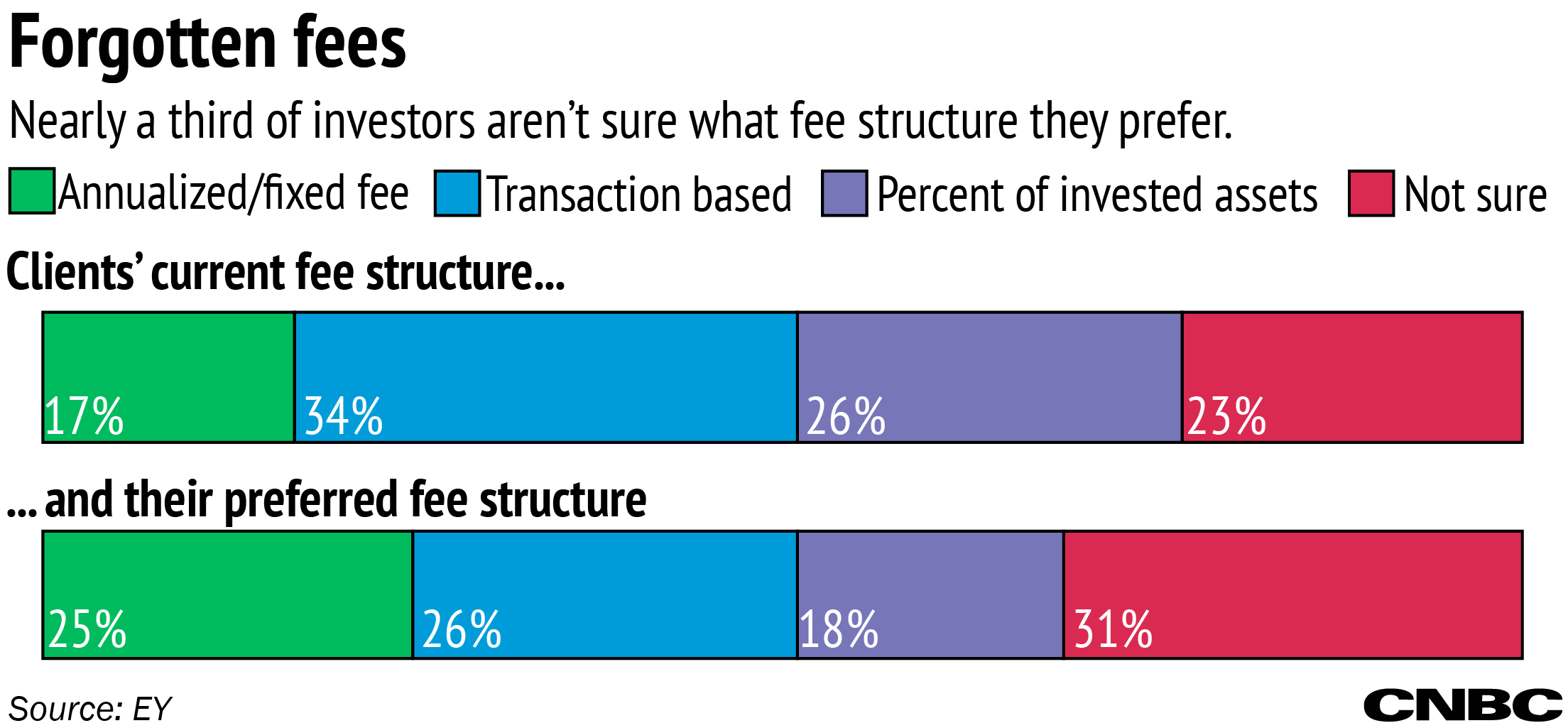

A full 23 percent of clients didn’t even know their own current fee structure. The typical fee structures are generally an annual fixed fee, transaction-based or a percentage of invested assets.

Among these three current structures, each has downside. Fixed fees suggest the advisor doesn’t have to work harder to get paid more. Transaction-based fees might incentivize the advisor to ask clients to put on more trades. And fees based on total assets pay advisors more just because you had more to invest, not because they did more work.

As a result of this confusion, financial clients were even more muddled when asked what they would like the ideal structure to be. Across the globe, 31 percent of individuals were not sure, and 35 percent of North American clients were not sure of the ideal fee structure.

The report said simply, «clients are becoming less sure about how they want to be charged,» across «every single region» of the globe. «Yet revisiting pricing strategy is not top of mind for firms,» the report said, adding that 90 percent of firms aren’t reviewing their pricing strategy.

The top that individuals give for why they might want to consolidate their assets to fewer advisors is «better pricing.» It’s not better portfolio returns.

Think about how so much advice these days is about lowering prices. It’s why exchange-traded funds have surged in recent years. People know that if they can just reduce prices, then the performance will come after that.

In a way, better pricing itself is better performance.

The report made the point that the advisor’s job is more about being a trusted hand to hold during times of market stress. It’s their job to keep clients calm and confident for the times ahead, more so than it is about specific market performance.

The report’s final conclusion: «The role of the financial advisor may become more like a financial therapist in the future.»