Jeffry Bartash

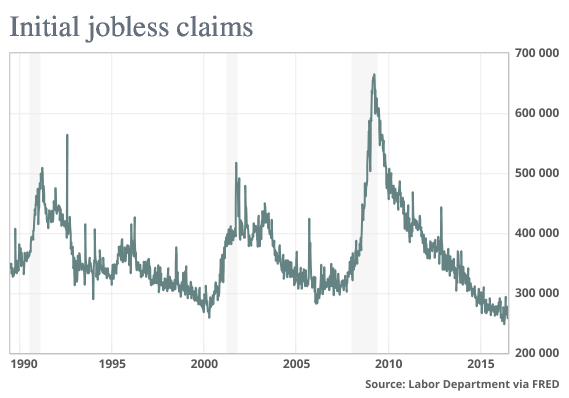

The government’s weekly report on jobless claims that shows layoffs are at a 43-year low is often ridiculed by skeptics. «A totally meaningless stat and has been for a long time now,» as one MarketWatch reader put it.

Not so, professional economists say. A new Goldman Sachs study finds that initial jobless claims are one of the best indicators at telling us when a recession is starting or a recovery is under way.

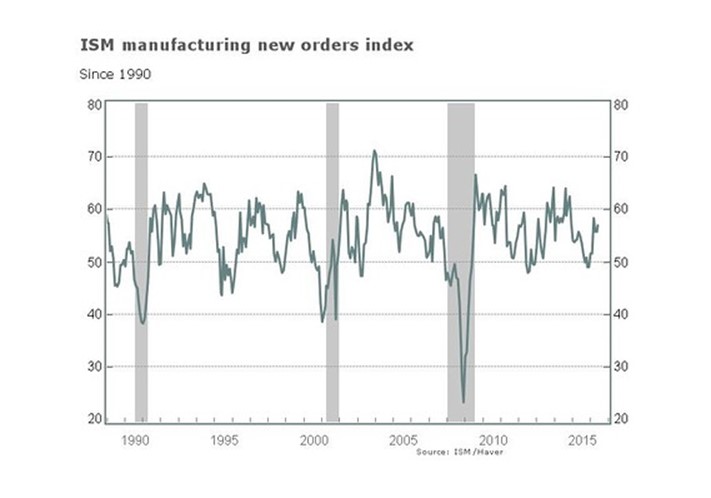

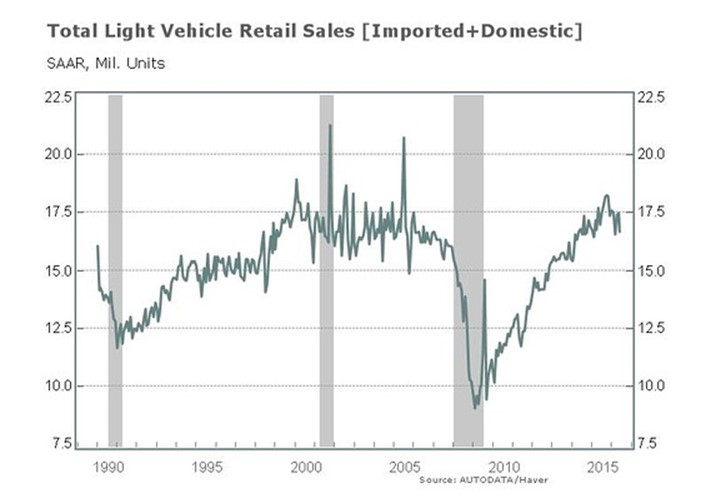

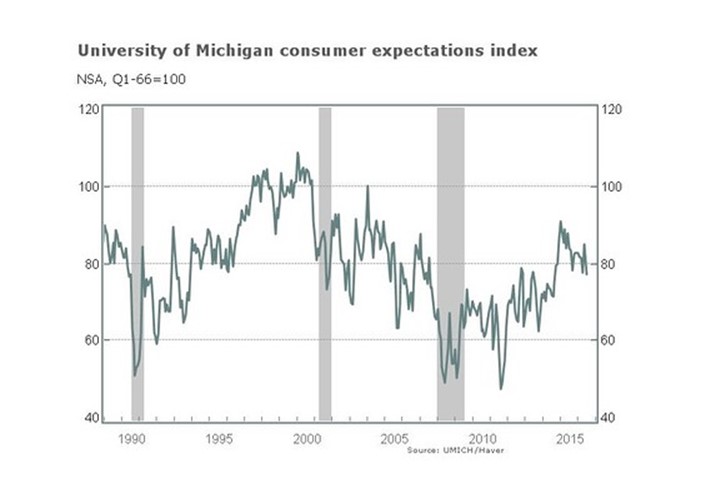

Other topnotch indicators include: auto sales; the component of a manufacturing survey for new orders; and the «consumer expectations» component of a survey that asks Americans where they think the economy is headed.

Here’s what these indicators tell us now: The economy is OK. Jobless claims are still low and new manufacturing orders have risen, but auto sales have tapered off and consumer expectations recently declined.

«At the moment, these key leading indicators offer a mixed message on the near-term outlook,» the Goldman report said.

In any case, what makes these indicators stand out among the crowd is that they are relatively high quality, more trustworthy and quicker to signal economic ups and downs.

«The idea is that the best indicators are released in a timely fashion and can be taken mostly at face value—what you see is what you get,» Goldman Sachs economists wrote.

Jobless claims, for example, reflect how many people lose their jobs each week and the report comes out more frequently than anything else. The states collect the data each week based on how many people file applications for unemployment benefits.

New orders for manufactured goods, published by the Institute for Supply Management, gives a sense of the level of demand for big-ticket purchases such as new cars, appliances, computers or industrial goods. The ISM index is based on responses from senior corporate executives.

Although manufacturing is a much smaller part oft the U.S. economy these days, households and companies are unlikely to make expensive purchases unless they are confident about the economy.

That’s where car sales figure in. The purchase of a new car or house is the ultimate signal that a consumer is confident about the economy.

The best way to find out what consumers think, it turns out, is a part of a University of Michigan survey that asks them where the economy will be in six months.

By contrast, some indicators such as housing sales and new home construction that accurately foretell an economy’s future path are less reliable at first glance.

«The housing data have some serious flaws: they are released later than many other reports, have high month-to-month volatility, and are subject to significant revision,» Goldman Sachs wrote.

One closely followed report that is not especially good at predicting future turns in the economy is the monthly U.S. employment report. Hiring tends to lag the economy by several months, so the 287,000 spike in employment growth in June or the dismal 11,000 gain in May don’t tell us much.

The index of leading economic indicators has never lived up to its title, either.

«Most economists approach the topic of leading indicators with a great deal of skepticism—and for good reason,» Goldman Sachs economists wrote. «Over the years the various attempts at producing a composite leading index have failed to predict recessions or called downturns that never materialized.»