Assets · Money

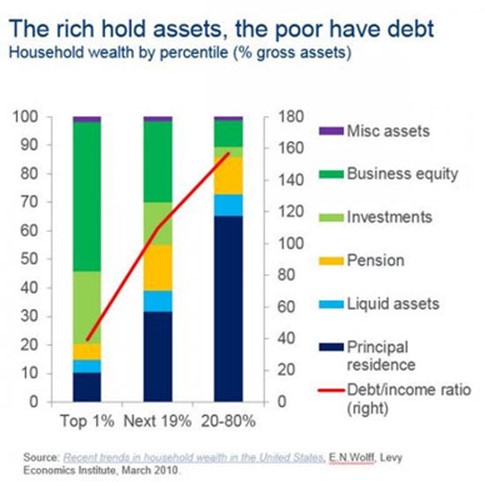

If you want to know how to become rich, just look at what the rich invest in. Frequent readers of my blog will not be surprised by the results of a study that I’m commenting about today. This study confirms that debt and consumerism is not good and does not create wealth. In fact the study shows us that the top 1% hold very low percentages of their net worth in their primary residences and most of their wealth in businesses and other investments. Even though they may own million dollar homes, this asset is minuscule when compared to their total assets. Just look at the graph below courtesy of Zerohedge.

To see what percentage you fall into based on your income, visit http://money.cnn.com/calculator/pf/income-rank/ and use the slider to input your individual income info.

For 8 out of 10 of us, this study concludes that most of our wealth is tied up in our primary residence. This is obviously correct as we saw how much destruction was caused from the real estate bubble. In fact, this single event destroyed a lot of wealth for many middle class families. If that wasn’t bad enough, it took away a borrowing pool for many others who used their home equity to finance vacations, college tuition, home upgrades, cars and many other items.

What’s even more telling is the debt to income ratio across the percentiles. Notice that the richest people only take on about 20% debt to their income. In contrast, the bottom 80% of the population has debt to income loads of about 90% of income. When you think about it like this, any job loss is catastrophic because their incomes are basically paying for everyday living expenses with very little left over in savings.

This data only proves what I’ve been teaching my subscribers, readers and listeners of my blog and podcast. The lesson here is the fact that the wealthy own assets, plain and simple. To be more specific, they own multiple income producing assets through investments in real estate, businesses and other special investments that pay out higher levels of income and are safer during extreme market fluctuations.

So I challenge you to take stock of where you fall within this data set and urge you to start taking some steps to get your money out of your primary residence and into some income producing assets that the wealthiest people utilize to live financially free lives. It’s not easy because we’re extremely conditioned to consumerism and encouraged to buy the latest gadgets or brand new automobiles but if you can put in the hard work to change your mentality on money and investing, a full and rewarding life lies ahead.