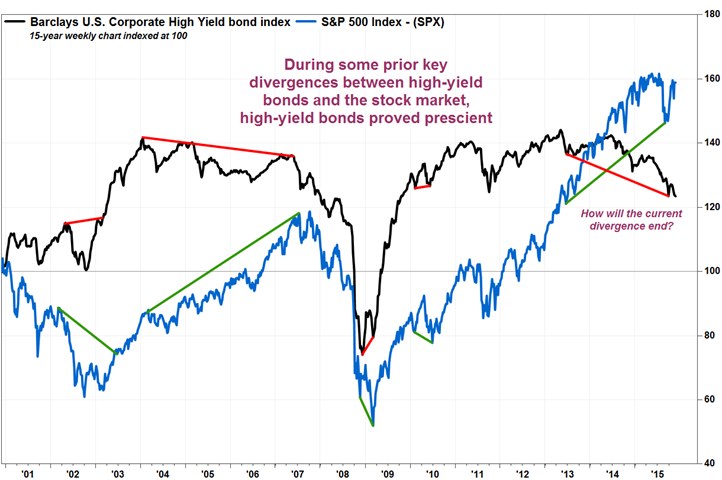

This chart warns that stock market investors should be on high alert

Tomi Kilgore

The continued downtrend in the high-yield bond market is warning that liquidity is drying up, which could bode very badly for the stock market.

When financial markets are flooded with liquidity, investors tend to feel safer about investing in riskier, higher-yielding assets, like noninvestment grade, or «junk,» bonds, and stocks. When the flow of money slows, the appetite for risk tends to decrease as well.

That’s why many stock market watchers keep a close eye on the longer-term trends in the high-yield bond market. If money is flowing steadily into junk bonds, investors are likely to be just as willing, if not more willing, to buy equities. When money is coming out of junk bonds, like the chart below shows, many see that as a warning that investors could start selling stocks.

FactSet

FactSet

«High yield corporate bonds are thought by many to behave like the rest of the bond market, but they actually behave a lot more like the stock market,» Tom McClellan, publisher of the investment newsletter McClellan Market Report, wrote in a recent note to clients. «And when high-yield bonds start to suffer, that is usually a reliable sign that liquidity is drying up, and bad times are about to come for the stock market.»

Over the last 15 years, the daily correlation between the Barclays U.S. High Yield Corporate Bond Index and the S&P 500 index SPX, +1.58% is higher than the correlation between the high-yield index and the Barclays U.S. Aggregate Bond Index, by a score of 0.525 to 0.334, according to a MarketWatch analysis of data provided by FactSet.

The selloff in high-yield debt has accelerated over the last several months, pushing aggregate junk bond yields to the highest levels in about four years, or well before the Federal Reserve opened up the liquidity spigot with its third round of quantitative easing. Read more about quantitative easing.

Don’t miss: Junk bonds follow stocks into loss column for the year.

And investors shouldn’t expect liquidity conditions to improve anytime soon. The minutes of the October meeting of the Federal Reserve’s policy setting committee, released earlier this month, showed that «most participants» were willing to raise interest rates in December. Rising rates tend to sap liquidity, as earnings on cash increase.

On top of that, the Fed voted Monday to limit lending to firms in trouble during a financial crisis.

«High-yield bonds are telling us that liquidity is in short supply already, even ahead of the Fed starting a rate hike series,» McClellan said.