Posted on February 18, 2014

«Sixty/40 is anchored in a really important existential point—the benefit of diversification. So, to say that 60/40 is dead is basically to say that diversification is dead—at least as far as it goes between stocks and bonds.» – Nicholas Colas

The 60/40 stock/bond portfolio is often used as a simple benchmark for a balanced asset allocation. Historically, this portfolio mix has been shown to offer solid returns with a nice risk profile over the long-term.

You could do much worse than a 60/40 portfolio as a base case scenario for a moderately conservative investment strategy.

Obviously, personal circumstances have to be taken into account, but it makes sense as a good starting point for those near retirement age or looking for a balance between growth and income.

Not everyone is a huge fan of the 60/40 mix.

Brett Arends of MarketWatch had this to say last year on the 60/40 portfolio:

Chances are, when you cut through the jargon and the spin, they’re all based on one big assumption: that a balanced portfolio of stocks and bonds, rebalanced regularly, will see you through whatever comes next.

Here’s the ugly truth. Contrary to what you are being told, this 60/40 portfolio of stocks and bonds comes with no guarantees. There have been long periods during which it has done very badly.*

He is right, up to a point.

Financial markets make no guarantees to anyone, especially in the short to intermediate term. No strategy is so infallible that it works at all times.

But this has always been the case.

You earn returns on risky assets over the long run because they occasionally go through long stretches of poor performance. You get your rewards by taking your risk, which is as it should be.

The old school 60/40 portfolio of U.S. stocks and bonds could have an uphill climb over the next decade or so. You could make the case that based on lower interest rates and higher stock prices that future performance could be lower than it’s been in the past. Who knows.

Yet Arends doesn’t mention the fact that investors now have access to a broader set of investment choices these days than we’ve had in the past.

You can create a highly diversified global portfolio in a number of different asset classes and sub-strategies with only a handful of low-cost funds.

In fact, I would argue that investors should be looking to allocate their portfolios much more globally these days to increase the benefits of diversification.

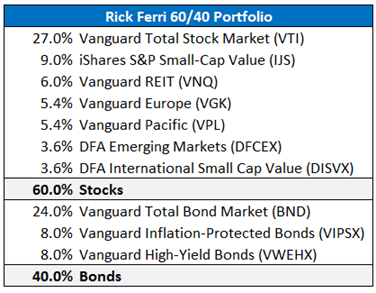

Rick Ferri of Portfolio Solutions shared his take on a globally diversified 60/40 portfolio in a recent interview with ETF.com. Here’s what Ferri came up with:

Ferri’s portfolio mix still uses the basic 60/40 stock/bond weighting but breaks down each asset class even further by including value stocks, mid-caps, small-caps, REITs, international developed markets, emerging markets, TIPS and high yield bonds.

Here’s a further breakdown of this portfolio including the various fund tickers:

I ran the numbers on this portfolio and compared them to the old school 60/40 mix of the S&P 500 ETF (SPY) and Vanguard Total Bond ETF (BND) from 2002-2013.**

Assuming an annual rebalance, the old school 60/40 portfolio returned a respectable 6.2% per year. Not bad.

But by making the portfolio more global and adding in the sub-asset classes, the Rick Ferri 60/40 portfolio returned 8.1% annually over the same time frame. Even better.

This is just one period so I wanted to see how the portfolio held up in different environments.

I used my favorite new backtest website, Portfolio Visualizer, to go back even further with this analysis using the indexes for these asset classes (since many of the funds haven’t been around long enough).

This analysis went back to 1985. I looked at the 15 year annual returns on the strategy at the end of each year. The average 15 year annualized return was 9.4% (the median was 9.6%) with a high of 13.2% and a low of 7.3%.

All the usual caveats of past performance apply here. Most long-term diversified asset allocation strategies look great on paper or in a backtested simulation.

It also helps that most of these returns occurred during the go-go years of the 80s and 90s when stocks and bonds both had excellent performance.

I think is the point Arends was trying to make. The old school 60/40 portfolio had a nice tailwind past decades, but may be facing a headwind from here (again, we’ll see what happens).

Yet even if you look at the 15 year stretch from 1993-2008 which includes the emerging markets crisis of 1997-98, the tech bust in 2000 and the financial crisis of 2007-08 you would still get returns of 7.3% per year in Ferri’s portfolio.

That’s pretty good considering U.S. stocks had two separate losses in excess of 50% during that time.

Here’s Ferri’s take from the ETF.com article explaining the 60/40 portfolio:

«Sixty-40 is sort of like Adam Smith’s ‘Invisible Hand,'» Ferri said. «We don’t know exactly why it works, it just always seems to work. In the end, when you look back over a 15-year period of time, it works.»

Notice the time horizon Ferri references here — 15 years. That’s an important distinction from saying the next few years could see lower than average performance.

These types of strategies generally work if you are patient and let them work by staying with your plan, rebalancing and ignoring the short-term noise of the cyclical nature of the markets.

Diversification is still the most consistent way to extract value from the financial markets over the long run.