Philip van Doorn

The S&P 500 Dividend Aristocrats Index has greatly outperformed the broader S&P 500 Index over the past 10 years, and includes many quality companies that raise their payouts year after year. But S&P Dow Jones Indices has a High-Yield Dividend Aristocrats Index that can help you find even higher-yielding stocks.

Most financial-media news is geared toward current events that can affect stock prices over the short term. But many investors are much more concerned with longer-term strategies for growth or income.

For long-term growth investors — that is, those who truly wish to invest in companies for many years — we recently discussed an approach that considers some key performance numbers, but more importantly, factors in investors’ own belief of whether a company’s products or services will remain popular for decades.

But some investors are primarily concerned with income, which has shrunk as interest rates have fallen since 2008. The Federal Reserve is expected to begin raising the short-term federal funds rate soon, from a range of zero to 0.25%.

If interest rates start to rise, market prices of bonds and preferred stocks will fall. That is natural and expected by most income-seeking investors. It can be especially difficult for investors holding shares in bond mutual funds or other income funds because of their fluctuating share prices, which are based on the market values of the securities held by the funds. There’s no guarantee that your losses in a bond fund will every be recovered.

But if you hold your own bonds or preferred stocks, you already know how much of a premium, if any, you paid when making the purchase, and therefore know how much you will lose (or gain, if you bought at a discount) when a bond matures or if a preferred stock is called. Holding your own paper can be wonderful because you not only keep all the interest or dividends being paid, you also don’t have to worry about market-price fluctuations.

Of course, this assumes your investment objective really is income, and that you are disciplined enough to keep holding the paper.

But at a time when interest rates around the world are so low, and when issuers are borrowing as much as possible to lock in low rates, the risk of a bond default appears to be growing, as Howard Gold described in great detail Wednesday.

Dividend Aristocrats

The S&P 500 Dividend Aristocrats Index SPDAUDP, +0.14% includes 52 companies among the S&P 500 SPX, +0.38% that have raised dividends each year for at least 25 years, according to S&P Dow Jones Indices.

«The index treats each constituent as a distinct investment opportunity without regard to its size by equally weighting each company,» according to S&P Dow Jones Indices.

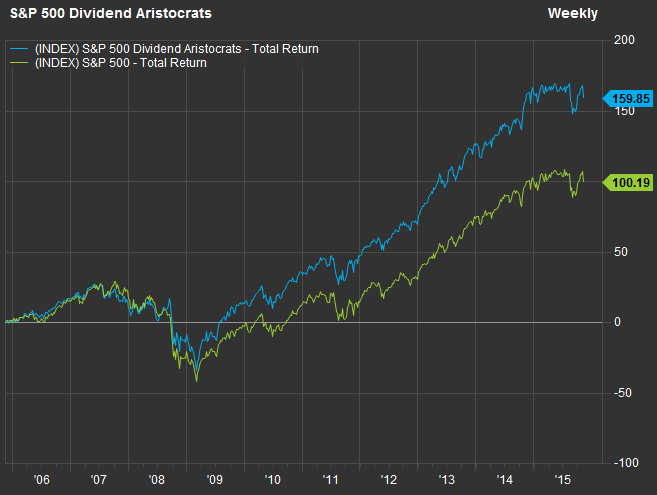

Here’s how the Dividend Aristocrats Index has performed against the S&P 500 over the past 10 years:

FactSet

FactSet

That’s big-time outperformance. Investors looking for long-term growth, who buy into the idea that a long track record of raising dividends implies strong overall performance, can «play» the Dividend Aristocrats via the ProShares S&P 500 Dividend Aristocrats ETF NOBL, +0.22% (Disclosure: I hold shares of NOBL.)

Here are the 10 highest-yielding S&P 500 Dividend Aristocrats:

| Company |

Ticker |

Industry |

Dividend yield |

| HCP Inc. | Real Estate Investment Trusts |

6.76% |

|

| AT&T Inc. | Major Telecommunications |

5.65% |

|

| Chevron Corp. | Integrated Oil |

4.70% |

|

| Consolidated Edison Inc. | Electric Utilities |

4.16% |

|

| Emerson Electric Co. | Electrical Products |

3.90% |

|

| AbbVie Inc. | Major Pharmaceuticals |

3.78% |

|

| Nucor Corp. | Steel |

3.68% |

|

| Exxon Mobil Corp. | Integrated Oil |

3.65% |

|

| Procter & Gamble Co. | Household/Personal Care |

3.53% |

|

| Wal-Mart Stores Inc. | Discount Stores |

3.27% |

|

| Sources: S&P Dow Jones Indices, FactSet | |||

A stock doesn’t need to have a very high yield to be included in the S&P 500 Dividend Aristocrats. The main idea is consistent dividend increases. Only four of those stocks have yields above 4%.

High-Yield Dividend Aristocrats

The S&P High-Yield Dividend Aristocrats SPHYDA, +0.28% has more aggressive criteria, since it starts with the S&P 1500 Composite Index, which is made up of the S&P 500, the S&P Mid-Cap 400 Index MID, +0.45% and the S&P 600 Small-Cap Index SML, +0.82% It includes 100 companies that have raised their dividends each year for at least 20 years (rather than 25 years for the S&P 500 Dividend Aristocrats).

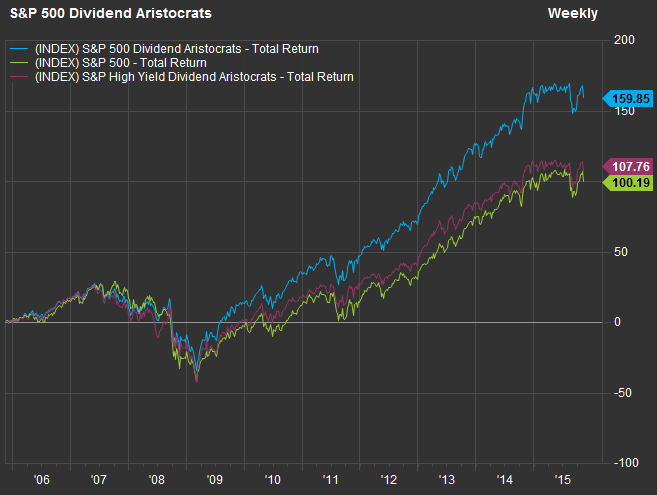

The S&P High-Yield Dividend Aristocrats Index has underperformed the S&P 500 Dividend Aristocrats Index by quite a bit over the past 10 years:

FactSet

FactSet

But the idea here is to produce a list of higher-yielding stocks of companies that love to raise dividends year after year.

Here are the 15 S&P High-Yield Dividend Aristocrats with the highest current yields:

| Company |

Ticker |

Industry |

Dividend yield |

| HCP Inc. | Real Estate Investment Trusts |

6.76% |

|

| AT&T Inc. | Major Telecommunications |

5.65% |

|

| Mercury General Corp. | Property/Casualty Insurance |

4.92% |

|

| Realty Income Corp. | Real Estate investment Trusts |

4.72% |

|

| National Retail Properties Inc. | Real Estate Investment Trusts |

4.70% |

|

| Chevron Corp. | Integrated Oil |

4.70% |

|

| Questar Corp. | Gas Distributors |

4.57% |

|

| Caterpillar Inc. | Trucks/Construction/Farm Machinery |

4.44% |

|

| Consolidated Edison Inc. | Electric Utilities |

4.16% |

|

| MDU Resources Group Inc. | Gas Distributors |

4.15% |

|

| Old Republic International Corp. | Property/Casualty Insurance |

4.05% |

|

| People’s United Financial Inc. | Savings Banks |

4.05% |

|

| Black Hills Corp. | Electric Utilities |

4.02% |

|

| Vectren Corp. | Gas Distributors |

3.92% |

|

| Emerson Electric Corp. | Electrical Products |

3.90% |

|

| Sources: S&P Dow Jones Indices, FactSet | |||

There’s plenty of overlap between the two lists, but now we have a list of 15 stocks, 13 of which have yields above 4%.

If you look at the industries of those companies, you may have some concern for Chevron Corp. CVX, -2.00% and the three gas distributors because of the big decline in oil and natural gas prices over the past year and a half. Then again, the companies have ridden out several price disruptions over the past 20 years, and they have continued to raise dividends.

Read:

Energy majors protect dividends even as oil prices slump

Caterpillar is another company you might be concerned about, since the decline in construction activity in China, along with the resulting drop in demand for copper and other commodities, have been very hard on the company.

Digging further

We cannot predict if any of the companies will cut their dividends, and their inclusion among the High-Yield Dividend Aristocrats speaks for itself.

But what we can do is compare the current yields with the companies’ free cash flow yields to consider how easily they’re covering dividends and the likelihood of further increases.

A company’s free cash flow is its remaining cash flow after capital expenditures. For real estate investment trusts, we are using funds from operations instead, because this is the generally accepted measurement of a REIT’s cash flow available for dividends.

We can then compare the companies’ free cash flow yields for the past 12 months to their current yields, to see if there is any «headroom.»

Here are free cash flow yields calculated by FactSet (except for the REITs, as described above) for the 15 highest-yielding High-Yield Dividend Aristocrats:

| Company |

Ticker |

Free cash flow yield – past 12 months |

Dividend yield |

‘Headroom’ |

| HCP Inc. |

9.46% |

6.76% |

2.69% |

|

| AT&T Inc. |

7.13% |

5.65% |

1.48% |

|

| Mercury General Corp. |

6.26% |

4.92% |

1.34% |

|

| Realty Income Corp. |

5.57% |

4.72% |

0.85% |

|

| National Retail Properties Inc. |

6.03% |

4.70% |

1.32% |

|

| Chevron Corp. |

-6.25% |

4.70% |

-10.95% |

|

| Questar Corp. |

2.94% |

4.57% |

-1.63% |

|

| Caterpillar Inc. |

8.58% |

4.44% |

4.14% |

|

| Consolidated Edison Inc. |

2.56% |

4.16% |

-1.60% |

|

| MDU Resources Group Inc. |

-6.32% |

4.15% |

-10.47% |

|

| Old Republic International Corp. |

13.98% |

4.05% |

9.93% |

|

| People’s United Financial Inc. |

4.81% |

4.05% |

0.77% |

|

| Black Hills Corp. |

-0.42% |

4.02% |

-4.44% |

|

| Vectren Corp. |

1.63% |

3.92% |

-2.29% |

|

| Emerson Electric Corp. |

7.66% |

3.90% |

3.76% |

|

| Sources: S&P Dow Jones Indices, FactSet | ||||

It’s important to keep in mind that this «backward-looking» comparison of cash flow yields and current dividend yields does not predict when cash flow will recover or whether dividends will go up or down. But it can give you additional insight into what effect temporary disruptions in markets really mean to a company.

You must also consider the direction of interest rates. REIT stock prices tend to slide, at least initially, when interest rates begin to rise. Are you really in it for the income? Can you afford to stay committed for many years, as the dividend income rolls in and hopefully rises? If so, REITs can be good investments for you, despite the inevitable seesawing price fluctuations.