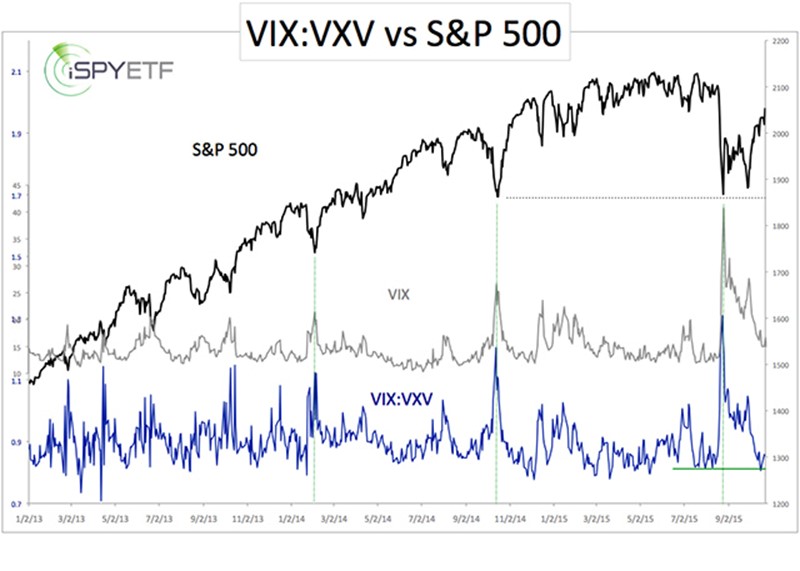

The popular VIX measures the market’s expectation of 30-day volatility. The lesser-known VXV measures the market’s expectation of 90-day volatility. VIX/VXN ratio readings above 1 indicate that investors are more afraid of short-term (30-day) volatility than long-term (90-day) volatility.

That’s a contrarian indicator, and rare readings above 1 are almost always followed by a calming of the VIX and rising stocks.