Sep. 14, 2011

«Let every man divide his money into three parts, and invest a third in land, a third in business and a third let him keep by him in reserve.» So it is written in the Talmud, a record of debates among rabbis about Jewish law dating back as early as 200 B.C. And so it is written on Page 1 of Asset Allocation: Balancing Financial Risk by Roger Gibson, first published in 1989.

We quoted the above from a recent Financial Planning Magazine article The Tamud Strategy. Roger Gibson quoted this saying on the first page of his classic asset allocation book and further illustrated how effective this strategy and its fine-tuned version has worked.

This strategy divides a portfolio into 3 parts: Equity (stocks — business), Real Estate Invetment Trusts (REITs — land) and Fixed Income (bonds & cash — reserve). We formed an ETF version of this strategy in the plan Talmud Strategy 3 Core Asset ETF.

The plan consists of 4 funds as follows:

| Asset Class | Ticker | Name |

| LARGE BLEND | VTI | Vanguard Total Stock Market ETF |

| REAL ESTATE | VNQ | Vanguard REIT Index ETF |

| Intermediate-Term Bond | BND | Vanguard Total Bond Market ETF |

| ROOT | CASH | CASH |

We then compare the two asset allocation portfolios: strategic asset allocationand tactical asset allocation with those of the Three Core Asset ETF Benchmarkplan. This plan consists of US Equity, Foreign Equity and Fixed Income as follows:

This three core asset plan is very popular in 401k plans: based on a study we conducted, we found a majority of company 401k investments offer only the above three asset class coverage.

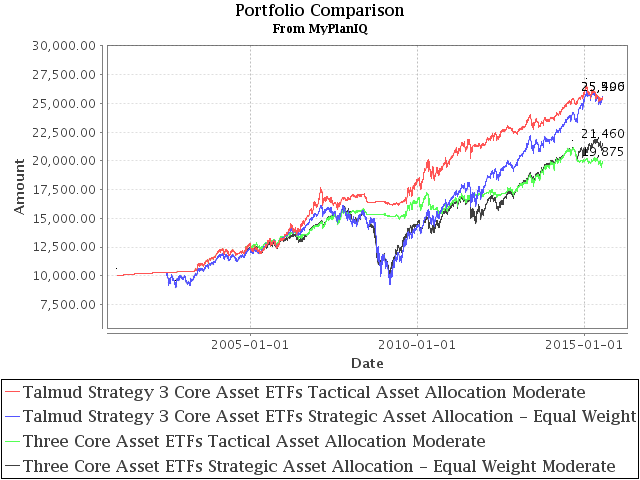

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies.

Performance chart (as of Sept. 13, 2011)

click to enlarge

Performance table (as of Sep 13, 2011)

| Portfolio Name | 1Yr AR | 1Yr Sharpe | 3Yr AR | 3Yr Sharpe | 5Yr AR | 5Yr Sharpe |

| Talmud Strategy 3 Core Asset ETFs Tactical Asset Allocation Moderate | 10% | 101% | 9% | 86% | 7% | 61% |

| Talmud Strategy 3 Core Asset ETFs Strategic Asset Allocation Moderate | 10% | 74% | 5% | 21% | 3% | 11% |

| Three Core Asset ETF Benchmark Tactical Asset Allocation Moderate | 10% | 122% | 4% | 44% | 5% | 48% |

| Three Core Asset ETF Benchmark Strategic Asset Allocation Moderate | 2% | 23% | 2% | 14% | 2% | 7% |

To summarize, The Talmud Strategy compares very favorably against a traditional three asset class plan that is often found in many 401k investments. The addition of REITs does increase the diversification effect much better than an international equity component.

For a longer time period performance, please see the index fund versionTalmud Strategy 3 Core Asset Index Mutual Funds.

Investors should take comfort in adhering to such a timeless investment principle for their retirement investments.