Posted May 4, 2015.

Our gut instincts have betrayed you once again…

In an unpredictable market, a gutsy call can cost you a fortune. Listening to your heart (instead of your mind) is a great way to lose money— and even confidence in your trading abilities.

On the other hand, sports are all about gutsy plays. Last-minute drives, buzzer-beating shots, and walk-off homeruns are what make the games interesting. Players often talk about being in the zone and letting their instincts and training take over during these critical moments. And because we love sports analogies so much, we often try to apply these ideas to life and business.

But when it comes to trading, this stuff just doesn’t work, got it? The stock market is a manipulative machine. It will twist your mind—and your wallet if you aren’t’ careful.

That’s why it’s so important to have trading rules. Your rules will keep you from following your guts down the wrong path. They’ll maintain your sanity. And get this, knucklehead: If you’re doing it right, your set of rules will lead you to consistent profits.

Of course, you don’t have to take my word for it. Ask any successful trader and they’ll tell you they’ve concocted a set of rules that have helped them along the way.

Recently, Barry Ritholtz conducted a lengthy interview with legendary technician Walt Deemer. And as usual, Deemer delivered plenty of funny, insightful, and thoughtful advice.

But when it comes down to how Deemer operated during his storied career with Merrill Lynch and Putnam, he always brings it back to the rules laid out by his mentor, Bob Farrell.

In his book Deemer on Technical Analysis (which is an excellent read, by the way), he lays out Farrell’s 10 rules—plus an extra one from the man himself.

Even if you never look at another stock chart again in your life, these rules will «make you look at the market intellectually, not mechanically,» Deemer writes.

Most importantly, they are as true now as they were fifty years ago.

Here are Paul Farrell’s 11 market rules to remember. I’ve made some notes for you in italics and added some charts, as well:

- Markets tend to return to the mean over time.

- Excesses in one direction will lead to an opposite excess in the other direction.

Hmmm, where have we seen phenomenon recently? Perhaps this Alibaba chart will jog your memory:

- There are no new eras– excesses are never permanent.

Does the dot-com bust ring a bell?

- Exponentially rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

Biotech, anyone? Sure, this epic rally might still have legs. But when it’s over, don’t expect these stocks to tread water. Parabolic moves don’t plateau.

- The public buys the most at a top and the least at a bottom.

- Fear and greed are stronger than long-term resolve.

- [Bull]… markets are strongest when they are broad and weakest when they narrow to a handful of blue chip names.

Breadth matters. It’s not a perfect timing tool– but you shouldn’t go all-in on the long side when most stocks have already broken trend.

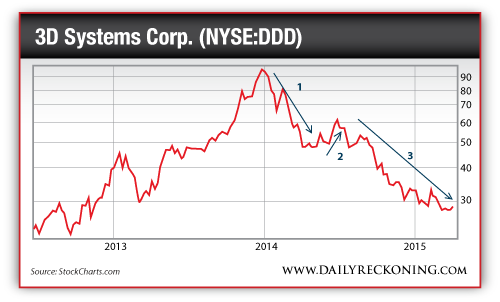

- Bear markets have three stages– sharp down, reflexive rebound, [and] a drawn-out fundamental downtrend.

DDD is a great example of a three-stage bear:

- When the experts and forecasts agree– something else is going to happen.

Don’t be a contrarian just to go against the grain. Look for sentiment extremes to gauge when it’s time to bet against the crowd.

- Bull markets are more fun than bear markets.

- Though business conditions may change, corporations and securities may change, and financial institutions and regulations may change, human nature remains essentially the same.

We aren’t going to wake up tomorrow to a rational market. Emotions reign supreme– whether stocks are moving up, down, or sideways.

Add these gems to your trading rulebook today… if you have the guts.

Regards,